Oh I forgot we could have tried Interactive Brokers statements. Good job we didn’t. I did think about Wise but guessed they wouldn’t be accepted because I tried to use Wise statements before when signing up for a Swiss brokerage and failed.

Closing the loop on this one–the English document provided by Citibank was also rejected by HSBC because account balance statements are not allowed. I went back and noticed all of my rejected documents had a list of reasons for rejection except for the Interactive Brokers statement which just said “this document cannot be accepted”. I emailed them asking for specific reasons why that document was rejected and received the same “this document cannot be accepted”. I emailed again asking for specific reasons why that document was rejected and it was then accepted.

YMMV but it appears IB statements, with a bit of persistence, will work.

In a couple of days she will get her monthly Citi statement, which we’ve had updated to English so we will probably use that.

Can you explain what the HSBC Expat account/service is?

![]()

In the online application for HSBC expat, they ask for your TIN. Am I correct in understanding that if I am tax resident solely in Taiwan, I can just provide my APRC number for this? Any earnings from HSBC expat would not put me over 1 million ntd per year outside Taiwan, which I believe means I would not need to report it for tax in Taiwan - is that correct? Does HSBC expat communicate much with the tax authorities here?

Not sure but you can ask the Tax Office in Taiwan if your APRC number is used as your TIN. For citizens it is out ID number.

For understanding tax obligations visit the tax office as they have English speaking professionals who can advise you on your tax obligations.

It is.

Not sure about this. As you know, at this time of the year, their official answer will be “you’re not tax resident in Taiwan”. (I don’t know how far they take the logic of this argument though, i.e., if they insist because the foreigner isn’t tax resident here they must be tax resident in their home country instead.)

That should be how it works, yes. I don’t know specifically about HSBC (maybe someone else does), but for many Taiwanese banks that’s usually not how it works in practice. There’s a whole thread about that, but maybe HSBC is better.

I have HSBC HK and HSBC Taiwan accounts. The jurisdictions HSBC HK will report to other tax authorities can be found online. Taiwan is not on the list. Perhaps because HK being part of China and not recognizing Taiwan they perhaps aren’t sharing information to Taiwan.

HSBC HK is also allowing some foreign nationals to open HSBC HK Accounts online and you do not need residency in HK.

You would need to state which country for your HSBC Expat and see if that country has reporting obligations to Taiwan.

Well HSBC Expat is not in Taiwan is it?

Fair point – I missed that part. My mistake.

(I have an HSBC account in the UK from when I was a student, but don’t really use it these days.)

I applied for an account two weeks ago because I wanted to qualify for the HSBC premier status that way before applying for an HSBC credit card in Taiwan.

However, my application is still pending because I am not receiving their text messages with my Taiwan phone number… ![]()

Application timeline:

- May, 20th: Filed out online application and verified my identity online. Submitted proof of address

- May, 28th: Received a reminder to provide a proof of address. Apparently, they had sent another email on May 23th together with a text message (both of which I never received).

Replied with the proof of address attached. - May, 30th: Received a text message requesting me to verify my identity online (which I promptly did)

- May, 31st: Received a text message requesting me to verify my identity online. I called them and they confirmed that this shouldn’t be necessary as I had already verified my identity.

- June, 1st: Received an email in response to my email telling me that the proof of address has to be sent using the link in the text message (which I never received). Was told that they just sent another text message to submit the document. As I didn’t receive this text message either, I called them again. They told me that they will send another text message within 48 hours.

- June, 3rd: Still haven’t received any text message regarding uploading the proof of address and just sent them another email to them asking to try with another phone number.

So far, the application process seems very tedious (especially their inability to send me those text messages and the long delay every time contacting their support…).

And based on this thread, I wouldn’t be surprised if the finally just reject my application based on an insufficient proof of address (my first attempt used a account statement from Wise - they did not outright send me a rejection, but the fact that they keep asking for proof of address makes me assume that they didn’t accept it. Next, I’ll be trying with an ESun proof of balance statement. Assuming I eventually get a chance to upload it…).

Overall, opening a bank at a Taiwanese bank seems really easy and straightforward compared to this.

Especially this requirement seems really strange considering that they market themselves as a bank for “expats”. It doesn’t seem that they’re well prepared for applicants outside the English-speaking world…

How did your application go?

Anyone else having issues receiving those text messages…?

Expat took me several weeks to open, US took not even two full business days. Of course already being a verified and qualifying premier user probably helped. So if this doesn’t work out, try US.

dunno, my experience (but I was still in HK) was quite nice, it took probably 2 weeks from application and then like a month to receive the cards.

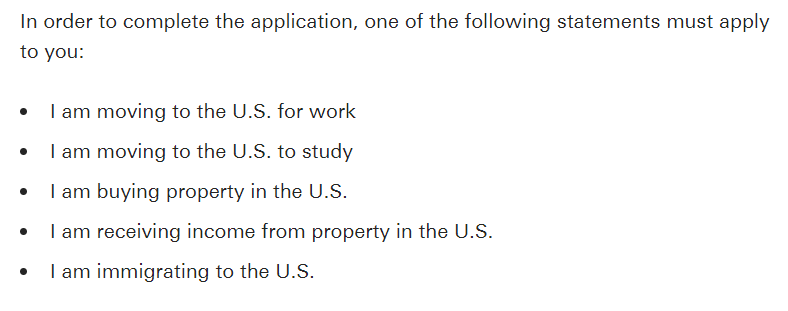

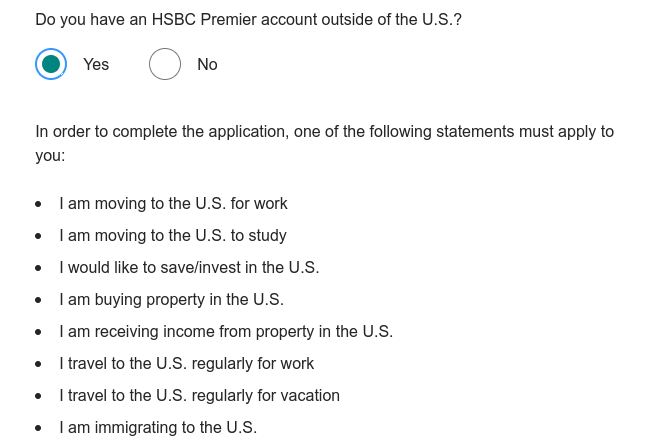

Looks like there are more options if you already have premier. Keeping 70k there in fixed deposit for sake of premier status elsewhere falls under “save/invest in the U.S.”.

That’s too bad.

I applied recently Jersey rather than HK (whether that makes a difference), I seemed to get all the sms messages ok, but I also recall completing everything online rather than submitting via a text message.

One funny thing did happen, my global money card took over 1mth to arrive (though digital was working immediately), contacted them to follow up as they said 10 days… they weren’t helpful so I cancelled it and got a new one sent to my UK address… which arrived in 24hrs… 2 days later the one shipped to TW (and already cancelled) arrived… Waaa!

One thing I would add… for me a Brit, Expat Jersey seemed to have the lowest requirements to achieve Premier status as is just maintaining a £50k balance, whereas HK required HKD1mil (£100k)

That’s because people in HK slightly above pauper status is it not?

I have HSBC HK Premier account but opened a new HSBC Premier account in Taiwan. I’ve never had an issue with getting sms messages from HSBC HK to my Taiwan mobile number.

Yes, being a pauper I had previously only ever achieved “HSBC One” status in HK… ![]()