But you were smart, you now magically live in Greater Taichung!

Personally I couldn’t do it now, but I lived on less than that for quite a long time. I built up my business from a seed of NT$250 I got from a paper round at 14. I used it to place a classified ad etc. etc. etc. My family couldn’t help, I grew up in government housing and they had nothing. At 16/17 there was a lot of peer pressure to get a ‘proper job’ at a supermarket or call center. By 18 I was just breaking through with some good contracts when my business partner ran off with the company funds. So I worked for 12 months as a special needs teaching assistant (only real job I ever had) for the equivalent of NT$200/hr and used the money to start again from scratch in Taiwan. I made no money for the first 9 months so stretched out $8000/month on rent, food, transport and bills. Of course I don’t regret it now but at the time it was rough and very difficult not to give up.

In the past few years it’s just been such a relief to have that behind me that I lost sight of what I should be doing with my income.

So what I’m curious about is how much people are willing to sacrifice now for the promise of something better 20, 30 or 40 years in the future.

But just for the sake of argument, if you started now at 20 making $40,000/month and invested not even 70% but half of it you would be investing $240,000/year. Then say you continue that until 40 while your investments make an average 6% per year. Your resulting $9.2m if somehow returning 5%/year would give you just under $40k/month to live off.

That is really a silly example because it makes a lot of assumptions including rate of return and an obscenely frugal lifestyle, but the point is that it’s technically possible. There are really quite a lot of people in a very similar situation to my example but of course they don’t retire at 40. We are all making decisions at some level about how much short term comfort to trade for long term comfort.

GIT and his better half are basically earning less than $40k/month between them but they are saving more than most engineers I know earning 10x that. It’s really not how much you make but how much you save and how you save it.

I didn’t read it at all ![]() If it’s worth a read I’ll take a look.

If it’s worth a read I’ll take a look.

I didn’t read it at all ![]() If it’s worth a read I’ll take a look.[/quote]

If it’s worth a read I’ll take a look.[/quote]

You may not get anything out of it. From reading your last few posts, you seem to understand the principles this site is trying to teach.

Here’s a simple question for a couple to consider if both are working. If you absolutely had to, could you live on just one salary, specifically the lower salary, without getting into debt? If the answer is yes, then do it, and save the higher salary.

That’s exactly what my wife and I started doing a couple of years ago, when we were 28. We live on the lower salary (mine), save hers entirely, and save a bit of mine as well. The first year we ended up spending a lot of our savings on paying off debt (all but the mortgage). Last year we saved nearly 60% of our income. Of the remaining 40%, about half went to taxes and we lived on the rest, including paying our mortgage and other bills, a week long Caribbean cruise, and a couple of trips back to Texas. It’s so much better to see our saving and investment accounts grow than throw it away on restaurants, cable TV, books, CD, DVDs, and all the other pointless expenses we use to have.

If you’re a single income family, you can also simply ask, if you absolutely had to, could you live on one-half your salary, or even less, without getting into debt? If the answer is yes, then do it, and save the rest.

I had a look through some of their articles, I generally agree but they all seem to go a bit rabid at the end. All good stuff but I do think that the formulas don’t translate directly to Taiwan because we are on a small island with very limited usable land, obscenely low interest rates, low tax and lower cost of living.

The idea about valuing a house by market rent is something I’ve been going on about for a long time. Housing here is WAY overpriced. TW$18,000,000 for a 40 ping concrete box in Taichung’s 5th development zone (Costco area)? Or double that and up in the 7th development zone where they can’t even afford to build any 7-11s?

We rent one of our company’s offices for $5,500/mo. It was our first office that we quickly grew out of but it’s nice and bright and we decorated it so I prefer working there than our main office. The landlord seemed a bit worn out with the thing so I asked him what he would sell it for. He said ‘we bought it for $6m but I guess we would settle for $5m’. Do the math, I would be dead before I ever paid that much rent on it. And no point raising the rent because next door keep asking me if I want to move into their bigger unit for $500 less.

When they bought it they must have known that even when shiny new a tenant would only be willing to pay maybe $10,000 max so what are all of these amateur property investors smoking?

I’m glad you made that point because it was shocking when we sat down and made a real budget. We always seemed to have just enough to get by and if you had told me to save then I would have said that there’s no way, we have too many outgoings. Then I started to think back to when the business was only just taking off and we were living off 1/4 the money just as comfortably.

Now I want us to save much more aggressively because I think we have got in the same rut. Our income increased since then but savings have not and I don’t feel particularly happier so we must have been spending the surplus cash on useless crap.

I really wish someone would have told me all this as a kid instead of just the usual ‘don’t squander your money, son’ and ‘don’t get into debt’.

That’s what we did. At the time, we used an Excel spreadsheet, and we recorded every purchase over the previous 6 months. It was time consuming, but amazingly eye opening. Now, our bank offers free software for analyzing spending and saving patterns, and we use that. I agree with what others have written about not relying on compounding anymore, given the historically low interest rates. But still, saving is better than spending, regardless of the interest rate. To take just one example, if your satellite or cable TV is costing you $50 USD per month, canceling the service and saving that same amount will give you $600 more at the end of the year than you otherwise would have had. In five years you’ve saved $3000. And that’s with 0% interest. Of course, the purchasing power of the dollar will been eroded by inflation, but it’s still better to have the money than not, right? Now add in every single cup of Starbucks, every book, every CD, every download, every trip to the movies, every trip to the beach, every piece of jewelry, every monthly payment for every debt you needn’t have incurred, and every other luxury purchased over a 5 year period and see how much money you could have saved that you didn’t. God, how it adds up!

Great thread. Your CD should not only be of music .

Well, that’s all a good start, but cups of coffee, CDs and cable TV are the small stuff. I think for most people, if you sit down and figure your budget you’ll find the big hole where the really big money goes is housing. That’s why if you’re REALLY serious about saving money you’ll plug that hole first.

And it may not look classy, it may not draw chicks, but if one’s truly determined I’ve got just the solution. . .

With a well-selected box placed in a sunny and cheerful location – say a quiet corner of a park or beside a scenic river – one may find the box life entirely tolerable. . . and KACHING! Just think about all the money you’ll be saving! ![]()

This is a great thread. Good discussion. I skimmed most of it but will return later for a better read. But I wanted you guys to keep up the good work.

MT: Haha. As Chris Rock said, “If a man could fuck a woman in a cardboard box, he would.”

llary: I have no idea how people in Taiwan are going to get any kind of return on their property investments. At my last place (in Taoyuan), I figure that after expenses, the landlady was probably making about 4,000NT/month. I wonder if that would even cover the interest on the loan. She can’t have been making any more money than if she’d just bought bonds or even just stashed the cash in a bank account. Unless they suddenly open the floodgates, the demographic trend is downward, meaning far less demand, so it’s not like they’re going to get the capital appreciation either. Who is going to want to pay an arm and a leg for an apartment that’s decades old?

Someone was recently telling my wife we should buy property where we live because one of the other foreign teachers near here has a mortgage in Taidong City. That’s in Taidong City, which is bad enough, but we’re in Taidong County. Who the hell would we sell it to later? It’s beautiful and all here, but there are no jobs, decent schools, hospitals, shops, entertainment or anything really here. Everyone else is moving out of this area as quickly as they can or they’re all trying to jump on some sort of tourism bandwagon and open a B&B or guesthouse. Watch that market get completely saturated in this country, if it isn’t already. I stayed in a hotel in Chiayi once for 450NT/night. How is anyone making money off that? On the other hand, people like my landlord have built a ton of rooms. My landlord is charging more than 1,000NT/night for his and I just can’t see how he’s going to get anything even approaching full occupancy on a regular basis.

Anyway, if we bought here, it would be lucky to keep pace with inflation. Unless we could pick something up that would cost us only slightly more (including maintenance, taxes, etc.) than we’d pay in rent, it would be silly. That’s even assuming we will stay here for the long haul, which we’re not even certain we will.

I started this sort of life 6 months after graduation from grad school. Those first months I bought the necessities in life such as a 42" TV, a PS3, and a MacBook Pro. All on a loan from my dad that I paid of with those first 6 paychecks. Then I had 6 really great saving months as my GF (now wife) was still in Taiwan. Then she joined me so the saving rate went down. But we were living in a cheap studio apartment so it was pretty good. We then moved to a small town for 1,5 years due to my job. Our saving rate was great but we missed the city too much. Now we’re living in a great apartment in Stockholm. It’s newly built with high standard. It costs us 1/3 of my net income though (she’s studying, no tuition fees in Sweden  ) so we can’t save a whopping 70 %. But we’re saving a lot. We live life to the fullest but none of us are interested in an extravagant lifestyle. We don’t own a car since you don’t need it if you live in central Stockholm. We’ll have a kid in august so that will erode the saving rate a bit further but we will get most of the stuff that we need from my cousins and my parents. In Sweden you get 480 days of parental leave to share between the parents with 80 % of you salary (up to a certain level which I have surpassed, but just barely). We’ll take that money and live in Taiwan for 6-12 months. That will probably increase the saving rate a bit, although those damn tickets to Taiwan will set us back quite a bit.

) so we can’t save a whopping 70 %. But we’re saving a lot. We live life to the fullest but none of us are interested in an extravagant lifestyle. We don’t own a car since you don’t need it if you live in central Stockholm. We’ll have a kid in august so that will erode the saving rate a bit further but we will get most of the stuff that we need from my cousins and my parents. In Sweden you get 480 days of parental leave to share between the parents with 80 % of you salary (up to a certain level which I have surpassed, but just barely). We’ll take that money and live in Taiwan for 6-12 months. That will probably increase the saving rate a bit, although those damn tickets to Taiwan will set us back quite a bit.

The one thing I regret is not investing more in stocks while a student. There were some good buys at the time such as Google and Apple that I accurately predicted.

Right now I’m doing pretty fine on investments in TSMC and Stockholm real estate funds during the crisis. But it’s still not that much money. I would be very happy with a 6 % annual return on low risk investments but as the world economy looks right now it seems like those days are over. My strategy right now is to save up some money for a few substantial and well researched investments. My friend who heads a hedge fund in New York advised me against buying an apartment in Stockholm and I’m renting right now. But one of my objectives with investing is to one day be able to buy something 100 % cash in a good market. That’s a real safety net if you ever lose your job.

My savings plan has already started. With my new baby I am looking forward to Taiwanese retirement in 20+ years. Then in a few years after a possible couple of kids I’ll sponsor my wife (who is younger than me) to train in something that will bring in the moolah. I’ve written a book about it, it’s called the ‘lazy man’s guide to investing’.

I skimmed the posts after this one so forgive me if it was already addressed, but the notion that a house could be bought with this type of cash is ludicrous. Investing $100/month at 10% interest for 10 years (a very darn good rate for such a long period) would only garner a bit more than $20K (that’s principle PLUS interest, not just interest).

Now, I’m not saying that the idea isn’t valid (money that was wasted could have earned a few thousand extra by investing it, nevermind keeping the principle) but a lot of your ideas do seem to come from an area of idealistic conditions. Before I was 30 I had all these grand dreams and schemes of retiring by 50 too. And a lot of them made sense. Then life (or should I say reality) got in the way.

Still you do have the right idea. Save early, save often, and save smartly. Just temper your expectations a bit.

Hey, I did say my examples were intentionally silly but they are still factual. There are quite a few 15 ping shitholes going for $600,000 not so far from our place.

The point is that I was screwing myself over by not realizing how NT$500 here and $300 there can add up to tens of millions over a lifetime of missed investments. Even 0% on something is better than 0% on nothing.

From this month I have our finances completely segregated so it’s difficult to touch anything except the bare minimum we need. Being self employed it’s not so easy to put a definite figure on earnings but I took the lowest month’s income in the past 3 years as a guide. Then I deducted our fixed payments such as NHI and mortgage. For the last few years I have been putting a fixed amount of money each money into our mortgage account for automatic payment of utility bills. It’s a high guesstimate so it’s grown slowly over time and I’ll carry on doing that since it’s a good instant buffer fund in case I can’t pay our mortgage or bills for a few months. Then I deducted existing investment commitments (all our savings so far are done monthly, automatically with fixed amounts). Finally I have a guesstimate of cash required for baby stuff, car maintenance/fuel, taxes and other essentials.

I’ve put aside a small amount of the remainder for the wife and me as personal spending but we have both decided to set a percentage of that to go into a savings pool that either of us can change at any time. For now my wife decided 50% spending, 50% saving while I decided 75% saving. In 10 years we can raid the pool to buy some big luxury item we really want (or reinvest it). The important point is that belongs to each of us personally so we have a real incentive to stick with the main plan.

Then we have a very small amount for joint entertainment such as cinema tickets and a very occasional meal out.

What is left will all go into fixed, automatic monthly investments. In total including our personal investment accounts we will be at just over 60% of income on savings. Increasing it any more would mean a decrease in our basic standard of living (downsizing the house, selling a vehicle etc.) Assuming that the business income will gradually improve over time we will have something left from the conservative investments which I think we will put into some riskier investments like individual stocks or even new business ideas.

Those people skeptical about compounding, where are your investments? I ask because my experience with the stockmarket over the past few years has been quite positive. I am invested in a diverse range of 10 mutual funds, one gold fund and 4 passive trackers, no individual stocks. Mainly I am interested in funds that earn dividend income. About 40% emerging markets, 40% Europe and 20% US. I set up my monthly payments then pretty much forget about them.

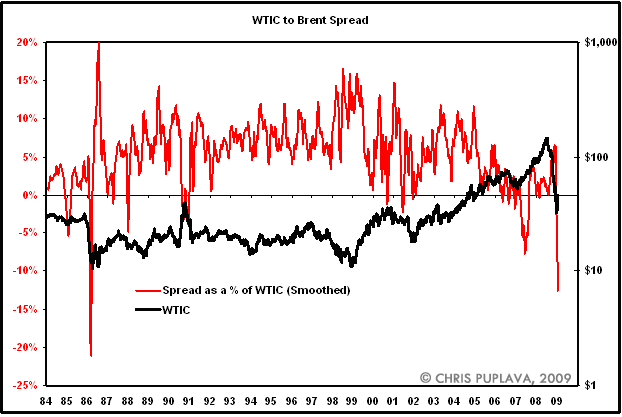

I think stocks are fantastic now, but in my opinion, you may be too overweight on emerging markets. They are getting the hell kicked out of them, and its probably not going to get any better, because they are so susceptible to agricultural inflation and aren’t going to do much better when oil moves up again. The massive spread between Brent and WTI crude, if history is anything to go by, indicates an imminent explosion in crude prices, and my bet is that Western & Japanese stocks and political systems can handle that much better than emerging markets can. I think American stocks are fantastic, especially the NASDAQ, at least for the next quarter or two.

This chart is a little dated. I think the spread is now something like -17-18% (approaching 1986 levels). The imbalances in this ratio have been increasing in frequency and strength in the last few years, which indicates to me that we are going to have massive volatility both to the upside and downside not only in oil, but probably in every other market, as well.

I am heavy on American and European stocks and copper. I have much smaller positions in Japanese stocks, cotton, corn, oil, and the Euro/Yen. I am waiting for the right moment to shift to oil and natural gas. I think the precious metals rally is effectively over for this year, but I said the same thing this time last year, and silver and gold continually make fools out of unbelievers.

I am a bit apocalyptic about the economy, because I see the growing specter of extreme volatility (rapid bouts of inflation and deflation), so I am doubtful about being either in cash or property, especially in a foreign country. I think I can time the swings (and I’ve been able to so far), but if you can’t, I’d say put your money equally in portions of stocks, bonds, property, precious metals and other commodities, and like you said, forget about it.

Japan has been good to me on several levels. We have some great customers there and our Japanese business is very profitable. I also have investments in some Japanese funds and they have turned out exactly as I hoped - strong, stable and predictable growth. Nothing particularly exciting but not disappointing either, just the kind of investment I want.

Great thread!

I’ve been following it from the get go and think it should be on everyone’s list of threads to follow.

About twelve years ago I happened upon “The Wealthy Barber” in a bookstore in Toronto, and after reading it I realized what a fool I had been when it came to saving and investment. I would recommend it to anyone not that versed in the language of investments and economics. It is Canadian based though, but many of the principles and advice are applicable wherever you live.

Keep the advice coming!