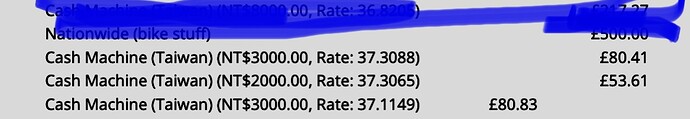

I went to withdraw 3000nt cash from my U.K. bank using Taipei bank, Taipei ATM.

All seemed good “please wait dealing with request “ this went on for 3 minutes or so,

U.K. bank sends a message saying 3000nt £80.41 withdrawal. No money had come out of machine or my card! Another minute or so says “error” transaction cancelled. Card is ejected.

U.K. sends new message saying £80.83 withdrawal returned.

So in that 5 minutes i profited 42pence because exchange rate had changed.

You probably want to wait a couple of days before going on a spending spree with your 42 pence. Don’t know about your particular bank, but for mine the shown amounts aren’t final until the transaction is settled.

Bet you wish you’d been withdrawing 3 million NT$. You’d have made enough money from exchange-rate arbitrage to treat your friends back home to a day’s worth of electricity.

Realistically, I think this is some sort of error due to the difference in buy/sell prices and will be adjusted away.

1 minutes worth!

Not sure what to treat myself to with 1.? nt before it’s reclaimed by the bank.

Works out to an hourly rate of about five quid. If you keep doing this for 18 hours a day 6 days a week, you can earn a handsome 540 pounds per week.

Sadly, 540 pounds will probably be worth about 540 TWD a week later, given the constant depreciation of the GBP…

Starling works quite well on the whole. Card and Apple Pay both fine. Don’t remember trying atm though

Starling is fine for ATM withdrawals. It’s the main card I use to withdraw money from the UK. The main benefit is the lack of a monthly limit (before switching to a shitty rate, as with Monzo and Revolut).

Wise also switches to a crappy rate (worse than mainstream banks) if you withdraw more than the 250 pounds/month limit.

I don’t have the Wise card, but I still have USD and GBP account details and those are quite convenient. They make it possible to receive ACH payments in USD (free), convert to GBP (decent rate and a small fee), transfer to a UK account (free), and withdraw here from my Starling account (Mastercard rate with no loading and no fee) or occasionally Monzo or Revolut (Mastercard or interbank rate with no loading and no fee, up to the monthly limit).

Wise increased its fees for USD transfers to Taiwan at some point last year, to the extent it makes it not attractive for doing this anymore. The above is the workaround I did, as well as asking my main client who pays in USD to just wire it directly to my Mega Bank Taiwan account (which is free on both ends, the USD end apparently being a perk of her Chase U.S. account).

Wise has become unresponsive in customer service. Trying for several weeks now, getting no replies at all