Thanks, much appreciated! Need to send some more stuff to ECCT this weekend, will include that too.

I went this afternoon to the Tax Committee meeting of the European Chamber of Commerce to discuss the tax residency issue again. The co-chairs of the Better Living Committee also joined, specifically for this topic.

It looks like they’re going to include this as a key issue in their 2025 position paper and they’ve asked me to prepare a draft, which I’ll probably seek @Mataiou’s feedback on before sending. So good news.

And now for the suboptimal news. The consensus around the table was that the initial focus should be on APRC holders rather than ARC holders, i.e., they’re going to try and push for APRC holders to be regarded as resident/domiciled by default under Article 7 of the Income Tax Act.

Obviously I think the presumption of residence should be much broader and I know @Mataiou does too. I pushed back on this compromise as much as I could, but the feeling was that seeking this for APRC holders first would be far more palatable for the government. So I can see the logic, even if I don’t fully agree with the decision.

One of the issues brought up was this potential downside of foreigners who might prefer to be treated as non-resident (affectionately referred to previously by @Mataiou as “grifters” lol). I’m still skeptical of how large this group is — the affected person would need to be a foreigner with an A(P)RC and some connection to Taiwan but who only wants to stay for <6 months each year. In this situation, it seems that the non-resident rate of 18% of everything would only become favorable for quite high incomes (back of the envelope calculation: something north of NT$4.8 million per year at a minimum, depending on number of dependents and deductions chosen, if we’re just talking about salary/wages; there may well be other considerations for different types of income).

For me, this hypothetical group of high earners who don’t really live here and don’t want to should be less of a priority than literally all of the foreigners residing in Taiwan, but okay.

I also suggested it would be a good idea to try and get the MOF/banks to provide better guidance/training making it clear that non-U.S. foreigners aren’t always tax-resident in their countries of nationality and it’s possible for us to be solely tax-resident in Taiwan (for the CRS forms I mean — the issue that started much of this discussion off).

For anyone who’s interested, below is an anonymized version of the file I prepared for the ECCT ahead of the meeting. It was basically intended to provide some background into the problem and collate everything that’s happened so far. Much of the credit goes to @Mataiou of course, because he’s the one who did most of the hard work collecting and sharing all the government responses.

(I’ll probably delete this link and unshare the file in a couple of days, but if anyone wants it later they can PM me. If you’re easily bored or not interested in rambling discussions of tax stuff, no need to download. ![]() )

)

This is extremely frustrating. The Taiwanese government has already signed double taxation agreements with many countries. It has already joined CRS. If it ‘wasn’t palatable’ then they should remove anti discrimination legislation and rip up their treaties.

They don’t get to have their cake and eat it.

Rant over.

I don’t disagree with that. ![]()

Tbh, it’s not entirely clear to me that the anti-discrimination clauses apply outside of situations where the DTAs apply (i.e., somebody being doubly taxed). The MOF seems to believe they don’t. From my reading, it seems like they should, but then I’m no tax lawyer.

It doesn’t seem like other people really know either (people I would expect to know, who work in taxation), and I also haven’t been able to find out much about their intended scope. ![]()

That said, it is nice to have some organization-level support, because it seems like individual complaints have gone about as far as they can (since the majority of the government doesn’t appear to give much of a toss about what we think on these issues).

Didn’t you also complain to the Australian Office at some point? I’m guessing you didn’t hear anything back? (It should be noted that the DTA with Australia doesn’t have a non-discrimination clause, just an annex saying they might try to negotiate one in the future if needed.)

They never replied and I didn’t follow up.

This is likely deliberate as Australia taxes working holiday visa holders at higher rates

I guess they’re being really stubborn about the legal technicalities and (whether deliberate or not) using the unresolved political status of Taiwan as a loophole. Remember there’s no such thing as “Taiwanese nationality”… we don’t live in the Republic of Taiwan, we live in the Republic of China. There’s only “Republic of China nationality”, aka some kind of Chinese.

Discriminating based on nationality would mean a policy that only ROC nationals can be domiciled. But that’s not exactly the case, since there are people who are ROC nationals but cannot get HHR, and therefore there are ROC nationals who cannot be considered domiciled (overseas Chinese, HK and Macau folks, mainlanders (the lucky few who have a way to get in), who have some form of TARC but aren’t yet eligible to permanently register household). So therefore it’s not discrimination based on nationality.

This fight needs to be a legal argument for considering HHR/Taiwan ID card status as a de facto nationality for the purposes of such anti-discrimination clauses. Or maybe wait for the new anti-discrimination laws which are hopefully better worded.

I didn’t expect anything else from the government ministries… this kind of issue needs a case written by Taiwanese lawyers argued before Taiwanese judges.

The APRC route is also worth pursuing… at least it would be progress, and there’s a much stronger case.

Such people should be the at the bottom of the queue (a handful of folks who are already well to do that just want to avoid paying their fair share of taxes?). There are over 750,000 foreign residents in Taiwan, over 3% of the population. We need the solution that’s best for all of them.

as of last Apr-24, 881,529 foreigners live in TW (Mainlanders and HK/MO ppl excluded). 91% of them are from SEA countries (did an interesting analysis in the nationality thread).

Tbh, after some consideration, I do see a rationale for starting with APRC only for domicile. It makes sense as has a very strong basis, permanent residency allowed in the country shows the intention to be domiciled here. Hence should be treated as a national with HHR, since they both have indefinite leave to remain (or right of abode if u will). It would be a very good starting point.

In a very confucian way, let’s take the middle of the road.

it already is, nationality here in TW is not a sufficient qualification for domicile or right of abode, everything is already connected to household registration.

agreed, but requires time and money. Now that we have ECCT attention, I do believe something will move. Also, with the US potentially signing a DTA with TW, the Amcham can get involved too. These heavyweights bring considerable influence to tw gov policy. And, as said, this doesn’t need LY intervention, so can all be done at EY/Ministry level.

I get that but what I mean is… it’s not enough. We need a proper legal argument written by professionals using Taiwanese law and jurisprudence to argue why, under the ROC’s legal system, HHR must be considered like nationality for discrimination.

When in Rome? ![]()

In discussion with the German Embassy the Ministry of Finance again denied that the double taxation agreement is violated.

Is exists solely on the basis of the [Ministry of Finance interpretation of] Taiwanese rules on (permanent) residence.

“This is a tough nut to crack, as there are many more questions associated with it.”

German Embassy will engage with the European Chamber of Commerce Taiwan to push for APRC residency rules change.

Is this from the German Office?

yes

I was thinking about this the other day too. From a quick look, it seemed like the U.S. tax bill isn’t a DTA per se but rather something written into U.S. law because of Taiwan’s status. I’m not sure how involved AIT is, but the bill appears to have been primarily written and pushed forward by some U.S. politicians (there was apparently some wrangling over which department holds responsibility for something like this).

I was wondering whether it might be useful to contact those to bring up this issue (probably needs some U.S. citizens).

I have contacts at Amcham (used to be a member), can easily contact ppl in the committees.

That was a very desirable outcome then, the German attitude will be extremely useful haha.

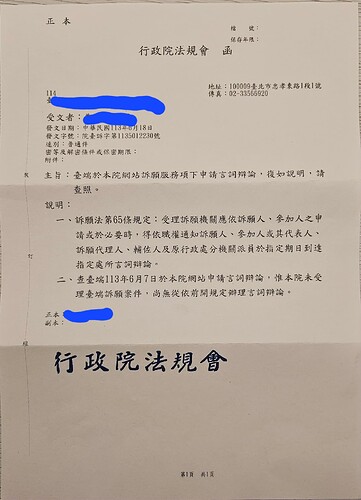

well, that’s it for me folks. Just got EY rejection letter of my administrative appeal:

Now comrade-at-arms @Andrew we all count on you and the EU chamber to continue the war and lead us to the final battle!

Just the one page? Quite the lazy finale…

It’s called being succinct. ![]()

No frills, I got them fruity