The politicians block the budget for political gain, there is actually no real immediate economic reason for it.

Good article on the “cliff” by former Reagan adviser Bruce “am I the only sane conservative left in the world?” Bartlett.

[quote]One option for dealing with the fiscal cliff is simply to kick the can down the road — that is, delay all the spending cuts and tax increases for a year while Congress and the White House theoretically negotiate something better.

But given the propensity of Republicans in the Senate to filibuster anything they don’t like, no matter how trivial, and the fact that virtually all have signed a “taxpayer protection pledge ” vowing never to raise taxes for any reason, the likelihood of compromise without severe external pressure is unlikely.

A better idea, in my opinion, is to let the fiscal cliff occur as scheduled and enact a fix retroactively, as soon as possible. This is an idea that the former director of the Office of Management and Budget, Peter Orszag , and the Brookings Institution economist William Gale have been promoting for several months.

The virtue of the Orszag-Gale strategy is that it changes the political dynamics. Once taxes have risen on everyone, legislation restoring the status quo ante for all except the wealthy would be scored as a tax cut. While doing this before Dec. 31 would be a violation of the pledge, doing so after Jan. 1 would not.

Similarly, negotiating some alternative to the automatic budget sequestration on the spending side — which everyone agrees is a stupid way to reduce spending — will proceed much more easily, because Republicans will be under intense pressure to negotiate in good faith for a change and avoid filibusters.

It goes without saying that in a world without tax pledges and filibusters, it would be in everyone’s interest to negotiate a sensible alternative to the fiscal cliff in the lame-duck session; indeed, it should have been done before Congress left town.

But we don’t live in such a world. Therefore, extreme and unpleasant tactics may be necessary to do what needs to be done.

My advice to President Obama: have your staff prepare an alternative to the fiscal cliff that can be sent to Congress as soon as it reconvenes this year, prepare for Republicans to reject it and then hope to negotiate something that can be enacted as soon as possible in the next Congress.

Kicking the can down the road is unacceptable and should be rejected out of hand.[/quote]

I don’t understand. What do you mean “block the budget”.

All lines of economics are wrong because none works … prove: world economy is in the shitters and no one knows the answer.

I don’t understand. What do you mean “block the budget”.[/quote]

They don’t allow the debt ceiling to be raised nor allow new taxes therefore they ‘block the federal budget’. In fact republican have done it quite a few times over the last 20 years.

I don’t understand. What do you mean “block the budget”.[/quote]

They don’t allow the debt ceiling to be raised nor allow new taxes therefore they ‘block the federal budget’. In fact republican have done it quite a few times over the last 20 years.[/quote]

America’s republican government has since the 50’s (over half a century) ran extensive deficits while in government much greater than the democrats. The deficits have been to privatized military and security providers. When the democrats have been in power they then block supply to the middle and lower classes in the hope that these services will be further privatized. It is a cycle of insanity.

Quite a few people know the answer. It’s just that no government wants the answer, because they would become unpopular for doing the right thing in the short term. The answer is a precious metals standard.

Oh, I see your point. Yes, it should be the responsible thing to do, block the printing of more money so that the system can’t go even further into debt. The printing of debt in order to service the loan on previous debt is a ponzi scheme. It doesn’t work. It’s as simple as that really. There are alternatives, so the government is just being irresponsible really when they want to raise the debt ceiling.

See below.

[quote]Quite a few people know the answer. It’s just that no government wants the answer, because they would become unpopular for doing the right thing in the short term. The answer is a precious metals standard.

[/quote]

The precious metals’ standard is already a proxy for money. That’s why so many governments have such large reserves of gold and that’s why every time the US government prints more money the price of gold is a direct corollary. However, a complete corollary is by itself impossible because gold measurement has some fundamental floors. Besides the ~120 thousand to 140 thousand tonnes of known mined gold, there is a much larger cache of unknown mined gold from Asia. Commonly known as Yamashita’s Gold, it was looted by the Japanese from all over Asia. It is in circulation but unregistered. In addition to this gold, there is the unknown quantities of mined gold left through out Asia, Africa, South America, Eastern Europe etc. The feasibility of developing a financial system against this is probably not reasonable. Additionally, gold is an already highly leveraged asset and the counter-party risk is extreme, i.e., you do not have a call option for real gold because the market is more leveraged than bank deposits. What’s more gold already behaves like a currency, but it is not supported by any taxation system. People do not pay tax in bullion. Gold is a proxy currency but it’s value is not reflected in human labor or endeavor.

Quite a few people know the answer. It’s just that no government wants the answer, because they would become unpopular for doing the right thing in the short term. The answer is a precious metals standard.

Oh, I see your point. Yes, it should be the responsible thing to do, block the printing of more money so that the system can’t go even further into debt. The printing of debt in order to service the loan on previous debt is a ponzi scheme. It doesn’t work. It’s as simple as that really. There are alternatives, so the government is just being irresponsible really when they want to raise the debt ceiling.[/quote]

You’ll notice I didnt get into the reasons, but the fact is there is no need for a fiscal cliff to happen now or anytime soon so it entirely a politically manufactured event. In fact the long term debt should be low on priority compared to other issues, especially when the US government is effectively getting the money at negative interest rates.

[quote=“Fox”][quote]Quite a few people know the answer. It’s just that no government wants the answer, because they would become unpopular for doing the right thing in the short term. The answer is a precious metals standard.

v

The precious metals’ standard is already a proxy for money. That’s why so many governments have such large reserves of gold and that’s why every time the US government prints more money the price of gold is a direct corollary. [/quote]

The real price of gold is no way similar to the present price based in U.S.D. or British pounds and so is not a direct corollary. The precious metals standard is not at all a proxy for money. Precious metals can not at all easily be used as bank deposits, or to purchase goods. Precious metals are also not directly traded between countries to balance deficits.

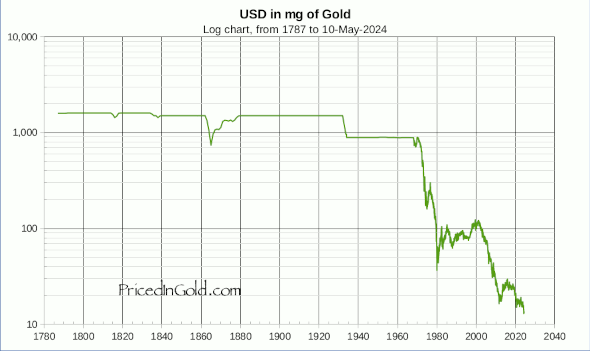

There are indeed flaws in precious metals standards, but these flaws are so minuscule due to the fact that the remaining deposits of gold which are reckoned to exist are far less than half of which has already been mined. Also due to the fact that remaining deposits are now so difficult to obtain, there is little concern that any fast influx would be affective in greatly adjusting the present value of the metal. You can even see that throughout history, the relative value of gold really hasn’t changed much at all. Roughly 1.5% inflation over 100 years in western history to be more accurate.

There is a lot of gold which is unregistered. People use it or wear it in all sorts of ways. This has little significance however as this will always be the case. It has been throughout history.

Well the writers of the U.S. constitution had a very different view than that. They had a view which was largely held for several thousands of years throughout history, across nations and continents. They knew very well that fiat currency would only get the country into trouble and so they prohibited it within the constitution and made certain that only a precious metals standard could possibly be employed.

Well you can only lever against something intangible, such as fiat currency, and there would be no point at all in putting options on a metal which basically doesn’t change in value. That’s the whole beauty of the thing. That’s why it makes perfect sense to employ it as a common currency. It prevents issues of over leverage and smooths out the market. It’s over-leverage and huge bubbles which gets the market into trouble.

Yes, gold is real money as it’s value is not diminished over time. Of course employing a precious metals standard makes taxation by federal governments very difficult to do at their present rate, which is also why the writers of the U.S. constitution also forbid any form of un-apportioned taxation. Governments should only be in the business of applying the law of the land, not being their own business enterprise.

I disagree when you say that the value of gold is not proof of value of labour or endeavour. If that were the case, then it would be free. It obviously isn’t free however, so my guess is that you perhaps mean that we aren’t presently paid gold as remuneration. Yes, that’s true, but that’s because we don’t have a precious metals standard.

Great. So you mean monetary policy should be controlled by how much of a mineral we can dig out of the ground? How did that work out for the Spaniards?

Anyway, Keynes was right in the long run.

[quote=“Elegua”]Great. So you mean monetary policy should be controlled by how much of a mineral we can dig out of the ground? How did that work out for the Spaniards?

Anyway, Keynes was right in the long run.[/quote]

Unfortunately for the Spaniards, they learned the same way that the Romans did, the British did, the Americans are, which was that extended war and empire expansion had to somehow be paid for.

It was the role of the precious metals standard which inevitably kept Spain in check and caused them to go bankrupt in the end. Any Dutch can be thankful of the precious metals standard at the time, for without it, they would all be speaking Spanish. Of course the old Austrian empire must be bummed out about the whole empire thing the most.

“Keynes was right in the long run?” Care to expand on that?

If you are talking about government meddling and fiat currency being a key to a successful economy, then I think the “long run” you are speaking of has been very short lived indeed. I think precious metals long term values are a testament to that.

[quote=“sulavaca”][quote=“Elegua”]Great. So you mean monetary policy should be controlled by how much of a mineral we can dig out of the ground? How did that work out for the Spaniards?

Anyway, Keynes was right in the long run.[/quote]

Unfortunately for the Spaniards, they learned the same way that the Romans did, the British did, the Americans are, which was that extended war and empire expansion had to somehow be paid for.

It was the role of the precious metals standard which inevitably kept Spain in check and caused them to go bankrupt in the end. Any Dutch can be thankful of the precious metals standard at the time, for without it, they would all be speaking Spanish. Of course the old Austrian empire must be bummed out about the whole empire thing the most.

“Keynes was right in the long run?” Care to expand on that?

If you are talking about government meddling and fiat currency being a key to a successful economy, then I think the “long run” you are speaking of has been very short lived indeed. I think precious metals long term values are a testament to that.[/quote]

Right, so in other words you want the monetary policy controlled by how much precious metal you can dig up. This can be hard on the natives and the environment. Just imagine what would happen with the mining equipment we have today if a gold standard was reintroduced. What would happen if we could no longer control monetary policy? Well, we actually have a proxy in what is happening in the Euro zone. A whole bunch of countries have no control over their monetary policy and are getting fucked for it (both the cause and lack of ability to correct for the bubble).

Like any tool, monetary policy can be abused for political and other ends and why we generally like an independent Fed. How much abuse would a gold standard bring? I find it unbelievable that someone would want to turn back the clock.

Keynes: Sorry. Bad economics humor. According to Keynes the long run it doesn’t matter, does it.

[quote=“Elegua”]Right, so in other words you want the monetary policy controlled by how much precious metal you can dig up. This can be hard on the natives and the environment. Just imagine what would happen with the mining equipment we have today if a gold standard was reintroduced. What would happen if we could no longer control monetary policy? Well, we actually have a proxy in what is happening in the Euro zone. A whole bunch of countries have no control over their monetary policy and are getting fucked for it (both the cause and lack of ability to correct for the bubble).

Like any tool, monetary policy can be abused for political and other ends and why we generally like an independent Fed. How much abuse would a gold standard bring? I find it unbelievable that someone would want to turn back the clock.

Keynes: Sorry. Bad economics humor. According to Keynes the long run it doesn’t matter, does it.  [/quote]

[/quote]

Yes, I want monetary policy controlled by how much precious metals we can muster. Seeing as we’re doing this type of mining anyway, I don’t see much difference as far as the environment goes. Do you think that we presently don’t mine gold or something? I’m fairly certain that the state of mining equipment is pretty much irrelevant to this conversation. f you wish to “protect” the environment, then I suggest you try telling the world that it ceases all types of mining at once.

The main issue with the Euro zone is that they have a single currency policy and fixed interest rate which spans over a great area and many various styles of economy which require micro management at the local level. This is also why according to the U.S. constitution for example, monetary decisions such as taxes were made to be at state level and taxes were to be apportioned.

I can’t really make much sense of your last sentence I’m afraid. Not to be disrespectful, but it was the constitution, section 10 which dealt with the threat of an independent banking institution which would deal in fiat currency and the total control of debt. It is the very presence of the Fed and its illegal dealings which have caused the very currency crisis which is in play. It was the gold and silver standard of the U.S. constitution which was brought in as a modern measure to curb the old issues caused by fiat currencies. Gold and silver standard was the more modern and stable method of currency. It was fiat currency which was outdated and full of fault. The founding fathers knew this very well.

I’m sorry but the turning back the clock argument for me makes little sense either. If I am correct in my interpretation of your argument, you are suggesting that our present method of debt building, money printing and heavy inflation is the correct and most appropriate way into the future.

Are you suggesting that fiat currencies have shown that they are a more stable platform for which economies to be successful upon and which create real wealth for all? And that there are some long term examples of this kind of economic success when compared to the miserable failings of an obsolete precious metals standard?

I have spent quite some time following historic currency trends, and types of money and trading methods of history. I have only seen how fiat currencies are very short lived when compared to any type of precious metals standard.

The average life expectancy for a fiat currency is 27 years. The longest living fiat currency is the British pound sterling, which since it’s employment has lost 99.5% of its value in a record which has spanned over 300 years. Since 1971 when the U.S. dollar came off the gold standard for the last time it has lost over 91% of its purchasing power.

That’s not even the scary part. Both of these most famed, and by global comparison, relatively hugely successful fiat currencies only maintain any present value because of all of the debt which must be paid off by future citizens of these countries.

Presently the average U.S. citizen is indebted, not by their own choice, to the tune of over 51,000USD. That’s the national debt. That doesn’t include their own unsecured loans or anything else, and that figure is on the lowest side.

Now on another note, think of this. If an average person saving towards retirement is to save up to around 150,000USD into their 401(k) by the time they are in their sixties, then how long will their money remain valuable into their retirement at the present rate of devaluation of the dollar?

And at what point in the future must that retiree’s savings be deducted to have to go towards paying off the national debt in the event of the all too prevalent financial blowout?

So, the situation you see is that there is no future for the U.S.D. If anyone thinks that simply by inflating it into Zimbabwe territory is the best way to deal with the national debt situation, for the sake of saving an entirely useless ponzi scheme, then they are disregarding their own future and their children’s future. Unless the idea of living in abject poverty seems attractive that is.

Never

- play poker with a man named ‘Doc’

- eat at a place called ‘Mom’s’

3)sleep with someone who has more problems than you - argue with a gold bug/creationist/GW denialist/flat-earther.

Speaking of which, Paul Braun, the guy the Republicans put on the House Science, Space and Technology Committee, along with Todd “Legitimate rape” Akins:

[quote] All that stuff I was taught about evolution and embryology and the Big Bang Theory, all that is lies straight from the pit of Hell. And it’s lies to try to keep me and all the folks who were taught that from understanding that they need a savior.

…

You see, there are a lot of scientific data that I’ve found out as a scientist that actually show that this is really a young Earth. I don’t believe that the Earth’s but about 9,000 years old. I believe it was created in six days as we know them. That’s what the Bible says.

[/quote]

fred- one of your boys!:

sulavaca said

Which means what? Since the average Briton is incomparably wealthier than they were 300 years ago.

Has the average American lost over 91% of their purchasing power? Are you claiming that Americans today can only afford 9% of what people in 1971 could?

[quote]Yes, I want monetary policy controlled by how much precious metals we can muster. Seeing as we’re doing this type of mining anyway, I don’t see much difference as far as the environment goes. Do you think that we presently don’t mine gold or something? I’m fairly certain that the state of mining equipment is pretty much irrelevant to this conversation. f you wish to “protect” the environment, then I suggest you try telling the world that it ceases all types of mining at once.

The main issue with the Euro zone is that they have a single currency policy and fixed interest rate which spans over a great area and many various styles of economy which require micro management at the local level. This is also why according to the U.S. constitution for example, monetary decisions such as taxes were made to be at state level and taxes were to be apportioned. [/quote]

I think you’ll find that it was the discovery of gold and silver in South America that eventually lead to hyperinflation in Spain and the fall of its once wealthy economy in the later 16th century. The problem with gold is that no-one knows how much gold there is. No-one even knows how much gold there is in America, already mined. No-one knows how much gold lies outside the Western accounting system. Gold has extreme counter-party risk.

You are looking at it the wrong way. If you had earned a dollar in 1971, then, according to the CPI chart provided by the U.S. gov. you would need 5.69USD today to maintain the same purchasing power of that dollar in 1971; which is altogether fine and dandy of course if you are still earning at a nominal rate of income since that time.

That however is according to the U.S. gov. which of course is biased towards its own statistics.

But then again, that’s only the CPI, which doesn’t seem all that bad…until however you look at what’s keeping that figure so low. Government DEBT.

During the second world war, the U.S. debt, inflation adjusted climbed from around half a trillion U.S.D. to around 2.5 trillion U.S.D. and then diminished to around a pretty stable 1.7 trillion U.S.D. during the period after the war and when the U.S. remained back on the gold standard, up until 1971. Since 1971 when the U.S. resumed it’s fiat currency however there was a sharp rise in the level of debt, and the U.S. is standing at an official 16 trillion dollars of public held debt today. That of course doesn’t even count the debt associated with any present programs and future payment obligations, which if accounted for actually put present U.S. debt levels at 500% of present GDP. Present government debt obligations, which are presently unaccounted for in any present budget and are not considered part of the national debt exceed 60 trillion dollars to be paid out in the next twenty years. That’s more than five times what Americans have borrowed for car loans, home loans, and anything else.

Put simply, it is government debt which has been keeping prices of goods artificially low, or in other words, true prices which haven’t been realised.

It’s the government which keeps inflating the economy and out of trouble. As long as the U.S. government can continue to get away with inflating the U.S. down the road, then the road will theoretically never end.

The problem is though however that the U.S. system cannot survive this situation for long. It’s creditors will not allow it and will certainly not work for free for long as their own U.S. dollar holdings go from being worth less to worthless.

During the period of “hyper inflation” in the sixteenth century prices went up over Europe around six fold in 150 years. As opposed to in the U.S. for example where prices (ref CPI) have gone up around the same amount in the past 40. Also debt back then was not such an integral feature of the economy.

You can also read about Spain’s failed long term war strategy at the time which I’m pretty sure didn’t help their economy one little bit: en.wikipedia.org/wiki/Habsburg_Spain

You are very concerned with the question of how much gold there is in the world. I’m far more concerned about how much debt we know our respective governments have on their balance sheets and how they are presently ever more effective in doubling the present money supply.

Here’s a lot of what we know about the present status of gold: numbersleuth.org/worlds-gold/