If you are, or know the author, there is another article on the site which I feel has wrong information.

Fact 3: The returns are GUARANTEED by the Taiwan government. – If there is a market crash the Taiwan government will prop up the account with the difference with a minimum of 2% annual return.

I got negative returns one time a few years back, so I don’t know how true this is. It’s weird because I also read (I believe on a government source) that they must give at least the same returns as one would get invested in government bonds. Maybe the rate for government bonds also went negative that year? Either way I don’t think it’s true that it’s guaranteed 2%. Might be worth researching that one a bit.

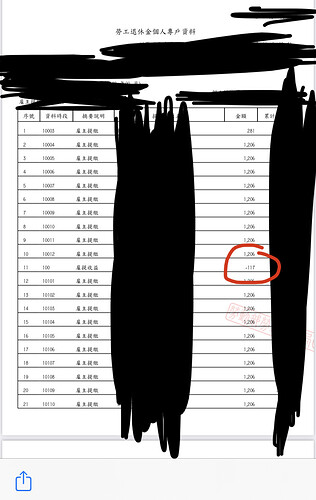

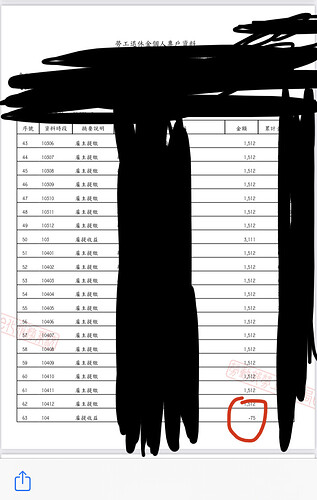

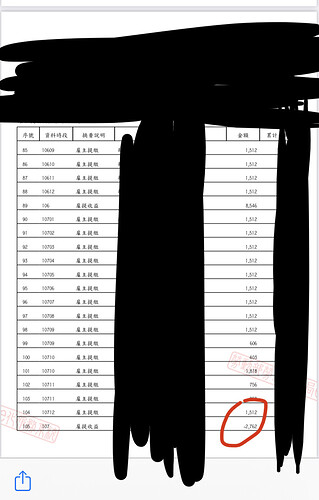

For example, here are some screenshots from a family members pension account.

Posting with permission.

Minguo years 100, 104 and 107 all had negative dividends. Not just specific to this person either, mine also had negative dividends for 107, although I wasn’t working in Taiwan in 104 so can’t confirm that one. Luckily, all the negative dividends have been quite small. 107 (2018) was negative 0.13%.

1 Like

The guaranteed returns policy I heard was a very recent addition.

Go to number 6 here to see.

https://www.bli.gov.tw/en/0010366.html

1 Like

Thanks for the link.

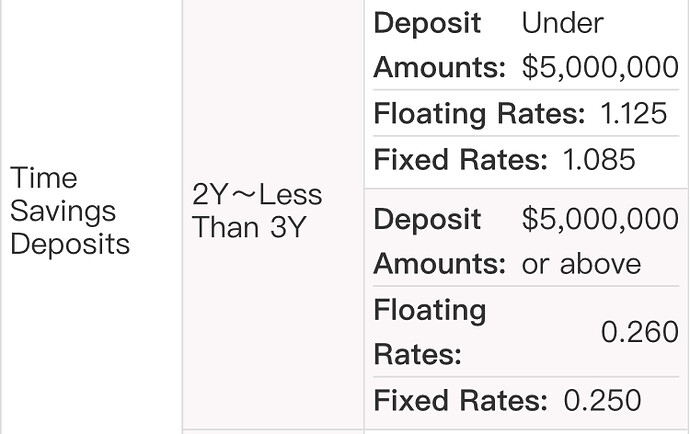

- Labor pensions have minimum guaranteed dividends

In accordance with the Labor Pension Act, the dividends accrued from worker’s pension fund may not be lower than the dividends paid for a two-year fixed term deposit from a local bank. Should accrued dividends fail to reach that minimum rate, the National Treasury shall compensate the difference. In the future, dividends from individual pension accounts may vary due to investment outcomes in the financial markets, but with the guaranteed minimum rate, when a worker eventually receive his/her pension payments, in addition to the principal accumulated from all monthly contributions, they will also collect dividends equivalent to the interest paid for a two-year fixed term deposit from a bank.

This is what I also saw before.

However, where is the 2% number coming from? The two year fixed term deposit rate changes all the time, and surely the labor bureau could just pick a bank with a really low two year deposit interest rate.

For starters it isn’t the Labor Bureau that manages the Labor Pension but instead the insurance bureau.

Secondly, it is very strange. I messaged the author and he amended it. He said he got it from somewhere but will find the source later.

I wouldn’t know what bank they’d choose but I’d presume it would be that crappy BoT.

Isn’t it the bureau of labor insurance?

That’s where I got my original pension info from.

In that case it definitely wouldn’t be 2%

1 Like

I actually expected BoT interest rate to be lower than that. More than 1% is not bad for a Taiwan bank.

Check out land bank for a good laugh:

1 Like

Already read it earlier

It is quite unfair not being able to open accounts online, and the decent interest rate accounts we aren’t able to access. Along the same lines, I don’t think any bank in Taiwan will allow foreigners to apply for a credit card online either. AMEX is the only card I could apply for online.

1 Like