Really dumb question: in Taiwan, if you have one currency say Yen and you want to use it to buy US$… can you just trade direct at the bank… or do you get hit by the double spread on each currency because you have to convert to NT$ first?

An example would be: I have 100,000 Yen that I purchased a while back. Want to exchange for GBP because I think it’s more advantageous.

I’ve chosen two currencies at random. Please don’t comment on this specific transaction because it’s just an example for clarity.

Thanks!

1 Like

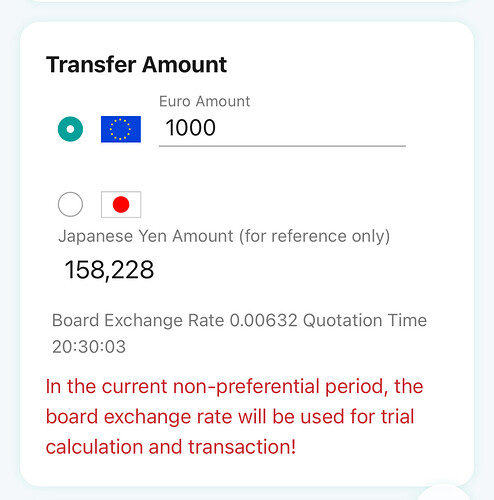

I just checked in the E.SUN app which has a “Foreign currency to foreign currency” option. If I try to do an exchange from EUR to JPY, I get quoted an exchange rate of 0.00632 or 158.228.

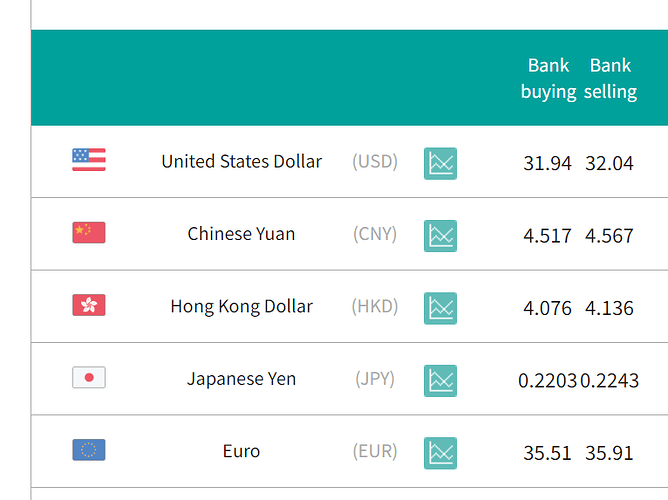

Meanwhile, the quotes are 35.51 for EUR → TWD and 0.2243 for TWD → JPY, so one EUR should give 158.315 JPY when doing two exchanges.

So not only do you pay the spread twice, you also pay an additional (hidden?) fee (note that it’s currently weekend, so outside market hours - which could have an effect)

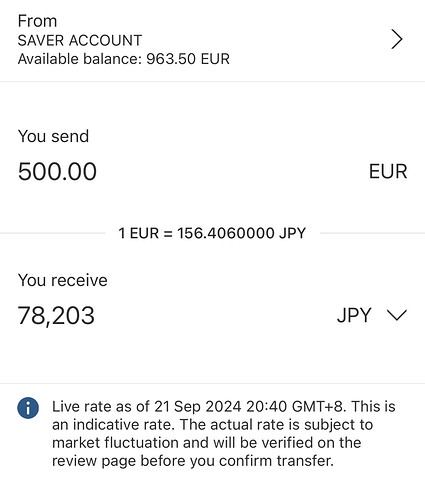

On the other hand, HSBC Jersey shows the following (can not check with HSBC Taiwan as I don’t have an active JPY balance):

So even though in Taiwan, you pay the spread twice, others might still charge more

1 Like

I think that is almost standard, as USD is the basis currency for global transactions; hence, why some unnamed countries are trying to increase their between-country F/X transactions without going through USD. Some banks with foreign F/X trading accounts will probably allow this.