BMO and questrade work for me. In fact a Taiwanese clerk helped me open account at BMO after I already became non-resident. They refused to let me open an investment account with them but allowed credit cards.

open online bank account in canada type this into an internet search and you find now most banks are doing so

The first link takes me to scotia bank and they say:

" By continuing, you confirm that you’re:

- A Canadian resident or you’re here to work or study."

https://hello.scotiabank.com/deposit/prequalification

Maybe some of these would allow in-person non-resident account openings. But I don’t see this as discrimination towards a non-resident Canadian. It’s more to do with tax compliance and banks refusing to bother with non-resident customers due to tax laws.

Problem is most banks in Canada charge monthly fees that other banks in other countries do not charge.

Update 3:

They got my FSC complaint fast!

The lady called just now and said the head office called regarding an FSC complaint and have admitted a flaw in their “regulations.”

They have now corrected it and I can keep my gold passbook!

damn, being a national (albeit NWHOR) is worth something haha!

Yeh! It’s great!

Yeah that regulation applies only to people from HK Macau and China who get NWOHR passports not to all the other people who naturalize.

They don’t get NWOHR passports from Taiwan. They only get the TARC and have to use the respective passports.

meanwhile, today applied for a Bank of Taiwan account as they offer a very convenient and free foreign currency cash pick up service at the airport (thanks for the tip @comfy123), the application process was incredibly smooth and been in and out in 1 HOUR!!!

Went to the chunglun branch in Songshan, Taipei. Just used my ARC and NHI card (although they first asked me to give them my passport too, I didn’t have it with me so refused, they agreed).

They also agreed after some confrontation to declare myself as sole tax resident of TW (took a good behind-the-scene talk with their branch manager).

The new app is quite good and all in English, as also their online banking. Only bummer was they issued to me an ATM-only card, not a debit card as I asked, but will apply tomorrow at the branch, already downloaded the forms.

Will also apply for the combo debit-credit mastercard, that sounds so nice.

Yehhhh about that… that’s another FSC complaint lol. The system for that doesn’t accept the TARC/ARC ID number

Yup I ask my wife about it. She has been using BOT and the cash pickup at airport for years. I say thanks for not telling me about it. She replies well you don’t have a BOT account and anyway you have your overseas atm cards and just get cash on arrival.

I think I’ve been cheated.

Apply for the online account haha

Yeah I could I guess… just too lazy and also I have foreign currency cash always keep some for traveling.

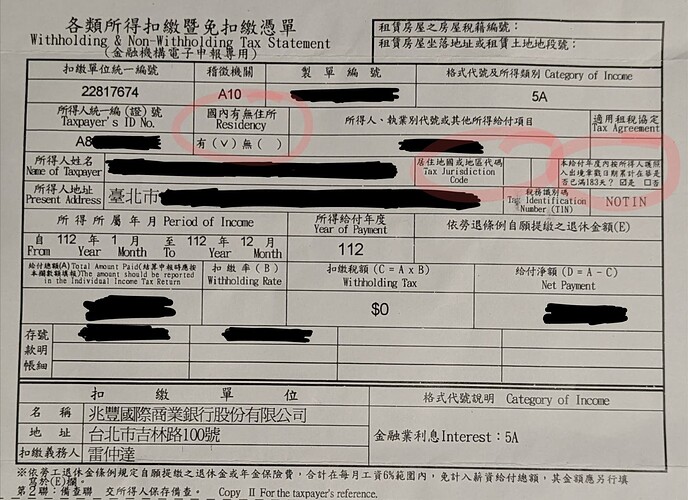

I just received my tax withholding statement for 2023 from Mega Bank. Astonishingly, they ended up listing me as a resident and that I stayed in Taiwan for >183 days in 2023 (this is true, but I didn’t prove it to them - just complained until all of us were bored and far beyond).

I’m not “GB” anymore as well. I’m not “ZZ” either. I’m just nothing. I’m pretty sure that means they haven’t filled out the form correctly, but I’ll take it!

Hi all for my 1st post.

I’ve got a letter from DBS related to my Withholding & Non-Withholding Tax Statement.

Assuming that I am APRC, physically in TW for 11 months per year, in this letter just received they stated:

- The residency status is marked as 無 (non-resident)

- The Tax Jurisdiction Code is listed as my own country of origin (as my passport).

- The 183-day rule is marked as 否 (means that I am not in TW for more than 183 days).

It’s worth mentioning that my personal account was initially with CITIBANK, which was seamlessly transitioned to DBS without any additional paperwork on my part, except for collecting my bank book at the branch.

However, in the past, when the Common Reporting Standard (CRS) regulations were introduced around 2018-19, CITIBANK had required me to sign some documents in person at the branch. These documents were filled out by the bank staff, and although initially, they had mistakenly equated CITIZENSHIP with RESIDENCY (which is quite crazy imho for a bank staff), due to my persistence, they escalated the issue to their supervisor by phone (probably in Taipei HQ) and then it was finally rectified as I was right.

Given this recent development with DBS, where no additional paperwork was requested from me, I am concerned that a similar mistake may have occurred again, just they filled up these docs by themselves, without asking me to go to the branch to sign anything.

In my understanding:

- RESIDENCY should be marked as 有

- TAX JURISDICTION should be TW (or ROC?)

- 183 days should be 是

Anyone who had the same issue before?

Or anyone with experience such as a banker, financial expert, or someone working in the financial industry, especially linked to foreign residents?

Thanks a lot

Oh boy you’re gonna like this.

Long story short, issue is with the tax office and their definition of domicile. Banks are just trying to avoid getting in trouble and being on the hook for any tax they should have withheld according to the official definition.

Basically it is the idiots at the tax office

Also people should stop calling themselves “foreign residents.”

Yes it seems to be the term used in Taiwan… but it isn’t an accurate use of language and essentially translates to “foreigner” which separates you from us Taiwanese.

The accurate term should be “Taiwan resident”

Yep, as @silly.putty pointed out, there’s a long existing discussion on this problem.

Only things specific to your case I’d note are:

- “ZZ” seems to be the normal code.

- I heard from a friend that their particular DBS branch/staff member knew how to correctly handle the CRS form for foreigners. That could make them the only branch/staff member in Taiwan that does, though.