Hello, I have a bit of a problem here and would like some input.  I went to file my taxes today (Taoyuan office) with what I thought were all of the correct papers. However When I got there the people told me that my previous employer hadn’t reported my taxes. This is odd because they gave me a witholding statement. I called them and got the secretary who said that she would talk to the accountant to look into it. She also told me that this is my problem. I informed not so politely that it is their responsibility to withold the correct amount of taxes and provide me with a statement. :raspberry: I later had a friend look at the statemtent and they told me that it just needs a proper chop on it. I will have to go back to them and get the chop. Well why is it that the tax office told me that nothing was filed in the first place? It was like pulling teeth just to get a statement that was improperly filled out. :grrr: Does anybody have suggestions as to what to do if it turns out that they didn’t report my taxes properly. :fume: I am hoping that I only have to get the proper stamps, which considering the people I am dealing with is hard enough!

I went to file my taxes today (Taoyuan office) with what I thought were all of the correct papers. However When I got there the people told me that my previous employer hadn’t reported my taxes. This is odd because they gave me a witholding statement. I called them and got the secretary who said that she would talk to the accountant to look into it. She also told me that this is my problem. I informed not so politely that it is their responsibility to withold the correct amount of taxes and provide me with a statement. :raspberry: I later had a friend look at the statemtent and they told me that it just needs a proper chop on it. I will have to go back to them and get the chop. Well why is it that the tax office told me that nothing was filed in the first place? It was like pulling teeth just to get a statement that was improperly filled out. :grrr: Does anybody have suggestions as to what to do if it turns out that they didn’t report my taxes properly. :fume: I am hoping that I only have to get the proper stamps, which considering the people I am dealing with is hard enough!

Probably they didn’t report your taxes and didn’t give the taxes they withheld from your salary to the tax office. They gave you what you thought was a legal document - the withholding statement - but without a stamp, knowing that you, a foreigner, wouldn’t realize something was wrong. Without the stamp, it’s not official. I think, however, that you’ll be able to use it to prove they withheld taxes - to the labor board if need be.

It may help to see what the withholding process looks like from the employer side to better understand what happened:

-

The employer pays the employee minus the withholding amount.

-

The employer takes a 3-part tax payment form to the bank to pay the withheld amount. The bank returns one copy to the employer, keeps one copy and sends the other to the tax office. The payment form will get a stamp from the bank showing the date paid, plus two chops over the first digit of the paid amount. (This part must happen within 10 days of the employee being paid.)

-

The employer fills out a 3-part withholding statement and a 2-part tax filing form and takes this along with the tax payment receipt from the bank to the local withholding office. The tax office will verify that the payment matches what is on the withholding forms, then will stamp the withholding statements and tax filing forms showing the date it was filed. They will return two copies of the withholding statement, one copy of the tax filing, and the tax payment form to the employer.

-

The employer returns one copy of the withholding statement to the employee.

Therefore it is quite possible that everyone is right. If the employer paid the withholding but didn’t file the withholding statement then the tax office will have no record of filing, and the withholding form would not have the stamp showing it was filed.

My guess is that your employer is still jerking you around though.

It apparently depends on who’s working in the Tax Office. One year in Taipei when a certain less than 100% honest company for which I used to work (which puts out an English teaching magazine that rhymes with “Handpark”) gave me a tax withholding form that was stamped but which was modified with Wite-Out*, the Tax Office was more than delighted to make some phone calls and light a fire underneath them. It was not MY problem at all, it was the company’s at that point. I’m not sure if they were just being specially nice to me or whether your office is being rather excessively “it’s not our job” with you.

*this company apparently thought that the Chinese name of Liquid Paper, “li ke bai” should be pronounced “li ke try” and meant “you can give it a shot, what the heck.” ![]()

I talked to my old school today to ask them what the F@%k is going on and they said something to the effect that they did pay my taxes but it is up to my new school to file the forms. They gave me some red pieces of paper along with my witholding statements that I am to give to my new employer. I have never had a problem with thisbefore and I have been in Taiwan for some time. ![]()

I will say that it is possible that my old employer is being truthful with me. Whenever it comes to paperwork this person always does things differently than the norm ![]() . (ARCs, for example, are also a lot of fun with her). Why can’t she do things the normal, i.e. easy way?

. (ARCs, for example, are also a lot of fun with her). Why can’t she do things the normal, i.e. easy way?

My Chinese is crappy :homer: . Is there a way to tell if those red papers I have are from the bank?

I had a hassle like this. Went to the tax office with everything and my terrible Chinese and walked out with a $30,000 NT refund.

How is it Company B’s responsibility to file paperwork for taxes withheld and paid into the national treasury by Company A? Or am I missing something obvious here?

(If you want, you can scan the papers and e-mail them, and I’ll take a look and tell you what they are.)

Yeah, I’m puzzled by why your new employer needs to get involved too. My guess is that they paid the withholding late and don’t want to bother with the hassle or possible penalties that go along with that, so they postdated the withholding date. But now since you are no longer an employee and presumably no longer have a work permit with them, they don’t want to get in trouble by claiming you as a current employee. There are also a couple of problems if they did this: 1) They won’t be able to claim your salary as a company expense and 2) If the withholding is dated for this year then it doesn’t help you with your last year’s taxes.

By the way, the red/pink form is probably the bank tax payment receipt. If I remember to, I’ll post copies of the current forms later on, but I’d also be willing to look at them and tell you what you have and if they have the right stamps and dates on them.

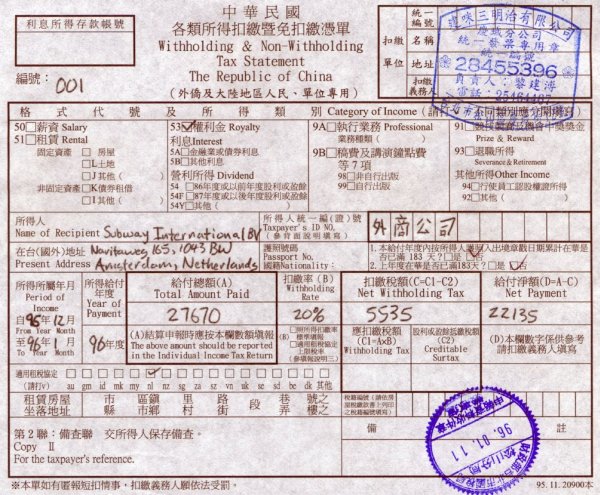

Here are the aforementioned form scans to help determine what you have. Please be aware that there are a lot of different formats for the withholding forms, so yours may not look the same depending on which tax office was used and whether the form was computer generated or written out. These are just examples.

The withholding form:

This is an actual filed withholding form. A form for salary withholding would have different boxes checked, but this gives you an idea what to expect. The stamp on the top right is the company’s ‘fapiao zhang’ (invoice stamp) showing their tax id and company information. This can be either stamped or written out. On the bottom right is the stamp from the tax office showing when and where it was filed.

The employee will usually never see the below items but they can show that the employer actually paid the withholding amount:

The bank payment form:

I already turned in these to my accountant so this is just a blank. The upper right again would either be stamped with the ‘fapiao zhang’ or filled out with the company tax id and information. In the center grid where the payment amount is entered twice, the bank will place a small stamp on the left most digit of each amount. Then they will stamp it in the lower right with a stamp showing when and where it was paid.

The tax filing form:

This is the form that shows the total amount of all withholding forms filed together. It will be stamped with a date and a serial number by the tax office.

Thanx Jlick.

Yes, those are basically the forms that I have been given-sans the neccessary stamps.

Here is how it played out when I went to the tax office again today. When I stepped up to the counter I got the same lady who I talked to a few days before. I showed her the the forms that had not been stamped again. She rolled her eyes and sighed because she knew she would have to call my old employer and explain the situation to her until she was blue in the face. I listened to the phone conversation and understood that my previous employer had not properly signed and filed the forms. My previous employer tried to explain to the tax office why they knew how to file taxes and the tax office didn’t. They explained that it was up to my new employerto file the forms have them stamped. They were basically acting like they knew more about taxes than the tax office did :homer: The lady at the tax office tried to explain that they were wrong this time and tried to tell them more slowly what to do. They also explained that you do have to file these things and the fact that they did give me tax forms and the bank forms was evidence that I did work for them and would have to pay tax on it. They had best co-operate. They then handed the phone to me and the secretary at my old job said to meet them the next day with the forms. They would have to take them to the bank and actually take care of them. That is the situation as it stands now.

Does it sound to anybody like they tried to get by without paying taxes? :raspberry: If they did, how would they think they wouldn’t get caught when I tried to file my taxes next year? Or are they just idiots? :loco:

I should clarify that the bank forms were indeed stamped. The witholding form was not.

Gee, you think so? ![]()

I know that they were trying to get by without paying. I just wonder how it is that they think they could give out the proper forms like that and not get caught when I went to file them. Are they morons? ![]() It just sort of seems to me that if you are not going to pay your taxes, there are better ways to cover your tracks than this. And if you have teachers working for you under the table (some of the other staff were), it is best to cover your tracks. Better to just pay your taxes so you won’t arouse suspisions about your other dubious activities. :s

It just sort of seems to me that if you are not going to pay your taxes, there are better ways to cover your tracks than this. And if you have teachers working for you under the table (some of the other staff were), it is best to cover your tracks. Better to just pay your taxes so you won’t arouse suspisions about your other dubious activities. :s

Alas today I finally got this all sorted out.  Sometimes things actuallydo work out as they should in Taiwan.

Sometimes things actuallydo work out as they should in Taiwan.