Currently looking into this again based on a post in another thread:

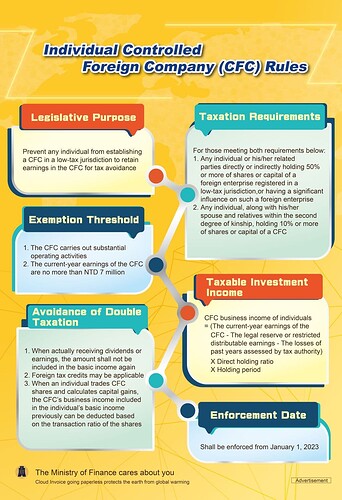

So starting from this year’s tax return in the next year, there will be taxation of CFCs in Taiwan. However, there’s an exemption for companies earning less than NTD 7 million.

I am not fully sure how exactly they will tax the CFC earnings, but from my understanding of that “poster” by the MoF it looks like this will be done as part of the basic income tax (formerly AMT).

Overall it sounds like that as long as one pays out enough salary and/or dividends from their overseas company to keep the profit under NT$ 7 million per year, there shouldn’t be anything to worry about under this new regulation. And even profits slightly over NT$ 7 million shouldn’t incur any additional tax if one is also paying tax on the salary in Taiwan (as the basic income tax is a minimum tax considering the total of all income and factoring in the taxes already paid).

And if someone really greatly exceeds NT$ 7 million in profit per year - well, I guess there should be some money left for paying the necessary taxes ![]()