Hi,

I am planning to relocate to Taiwan on a Gold Card soon (given that my Gold Card application will be accepted).

My goal is to continue working remotely for my former employer in Europe. However, they are a small company without a dedicated HR department, so in order for them to accept my proposal to work remotely, I need to offer them a way they can “hire” me without causing them too much effort in terms of taxes, compliance and stuff. So them actually hiring me as an employee is most likely off the table.

At the moment, I see three possible options:

-

First, I could just work for them as a freelancer / being self-employed. Apparently, this seems to be possible on a Gold card and I could also apply to join the NHI after some waiting period. However, this would not allow me to reapply for a Gold Card after it expires as income from self-employment does not seem to fall into the “income” category required for attaining a Gold Card. So freelancing does not seem to be ideal in my case.

-

Second, I could set up a company in Taiwan. However, I am not sure if my old employer would be happy to receive invoices from Taiwan without European VAT and without a European bank account to actually pay the invoice. And they might be afraid that their local tax authorities might not accept invoices from Taiwan without even more bureaucracy involved…

-

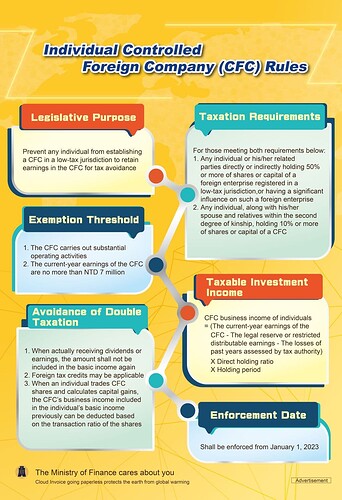

Third, I could set up a limited liability company in Europe (possibly Estonia because they allow creating one without needing to be a resident there). This type of company could send invoices with a European VAT id, so it would probably the “easiest” option for my old employer to hire me. The company could either pay out dividends (which would be taxed in Estonia) and / or could pay an employee salary and/or shareholder salary. The employee salary would be tax-free in Estonia if I can produce proof that I pay taxes for this money in my country of residence (which would be Taiwan).

So at the moment, I am really in favour of choosing option 3.

However, doing some research, I came across an article Company Requirement for Hiring Employees in Taiwan which clearly states:

Companies that do not have a legal entity in Taiwan cannot hire employees. If a foreign company wants to hire an employee in Taiwan before they set up a legal entity, they must hire the employee through an Employment Solutions / PEO (Professional Employment Organization) provider.

Is that true?

That kind of “provider thing” doesn’t sound easy and/or cheap unfortunately…

Additionally: If I would create my own company in Europe and hire myself as an employee: Would this be considered as regular employment income in Taiwan? Or does it also fall into the category of self-employment income (which would bring me back to the issue of not being apply to reapply for the Gold card again…)?

So far, I am quite certain that it is definitely not “foreign sourced” income as I would be doing the actual work in Taiwan. In fact, I am actually looking to pay taxes 100% in Taiwan if possible, so that I have proof the money is not untaxed which might cause tax liability back in Estonia or even my home country with much higher tax rates. So trying to “avoid” tax payments in Taiwan would definitely be really counterintuitive in this situation, it seems.

Any ideas? Or someone in a similar situation?

Can I actually be “employed” (according to Taiwanese regulations) without having an employer in Taiwan? Or does this situation always lead to “self-employment”?

Looking forward to any response!