I have several complicated questions about the scope of gaofei (9B) income, having read every post about this topic on the forum at least a couple of times. (I’d particularly appreciate hearing what @yyy and @tando think, on the basis of their previous posts, but all input welcome.)

As a starting point, Article 4 of the Income Tax Act:

Income tax on the following categories of income shall be exempted:

23. Individual income derived from written articles, copyright books, musical compositions, musical productions, dramas, cartoons, or as remuneration for speeches and lectures on an hourly basis. However, the total amount of such income for the whole year shall not exceed NT$ 180,000;

Question 1: The language of the act seems ambiguous here – does “on an hourly basis” refer to just speeches and lectures, or does it apply to all of the preceding items as well? In other words, would income derived from written articles etc. only be covered if paid on an hourly basis, or is it also covered if paid on the basis of, say, a fixed fee relating to the number of words?

Question 2: Is anyone certain whether editing falls under the scope of gaofei at all? The consensus from previous threads appears to be that it does, whereas @tando suggested that it might not in a previous reply to me ages ago. The three specific situations I’d be interested in are (i) editing scientific manuscripts (on which my name wouldn’t appear), (ii) writing news articles (on which it would), and (iii) editing news articles (on which it wouldn’t).

Question 3: I found a couple of official sites (here and here) where the quoted text above is followed by “for which each payment does not exceed NT$5,000”, but both of those appear to specifically refer to non-residents – notably, this restriction doesn’t appear in the Income Tax Act itself. So, does it actually apply to residents as well, or only to non-residents?

Question 4: The NT$180k limit – would I be correct in assuming that any gaofei income above this value is taxed at the normal rate while the first NT$180k is exempt (as opposed to exceeding this limit meaning that the gaofei exemption can’t be applied at all – again, the wording seems a bit ambiguous). Or…would the excess be classified as professional practice income or something and be taxed at a much higher rate?

Question 5: Is the gaofei exemption limited to work paid in Taiwan and labeled accordingly as 9B during payment, or would it also include work done for foreign companies with no presence in Taiwan? In other words, can something legitimately be claimed as gaofei during filing if it wasn’t paid in Taiwan and labeled as 9B by the employer?

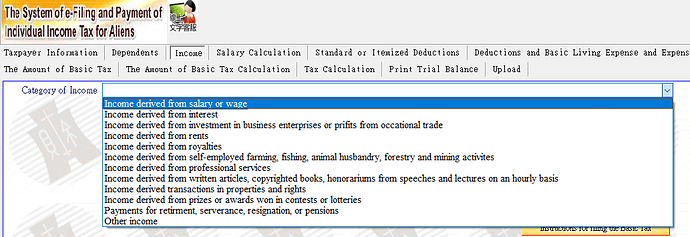

Question 6: @yyy you suggested in a previous post that gaofei is “non-reportable” – is that really true, or shouldn’t it still be reported? This category of income is included in the filing software:

Thanks in advance for any responses – I realize that these are complicated questions that maybe nobody knows definitive answers to. I submitted my tax return earlier today with everything under “income derived outside the ROC” (5F), but I’m just wondering now whether I should have done it differently and tried to claim the gaofei exemption for some of the work. It looks like I’ll need to head to the tax office in the next couple of weeks anyway to get them to accept my documentation and I’ll probably query this with them then, but just wanted to see if anyone knew some of the answers in advance. ![]()