yep, totally agree. installments don’t earn points

Incidentally, just came across this while looking for something else - CTBC is included.

Full version here: https://download.tax.nat.gov.tw/ifn/UserGuide.pdf

How do you file taxes if you have no paperwork. Been in Taiwan last year 4.5 months, so only need to pay taxes on a small salary my LTD pays out to myself.

In Cyprus you don’t get anything on paper. I pay myself the minimum allowed the rest is dividend. So 24.000ntd per month or so. Or better just drop it all together.

The only thing I can print out is an email stating my tax calculation in Cyprus…

I didn’t even bother to send that money every month but only once per year all months … so bank statement won’t do either…

This is going to suck, because you’ll need to pay the non-resident rate of 18% (I think) with no deductions or exemptions. From what I understand, that’ll only be for the salary component paid while you were in Taiwan though.

The tax office has a list of required documentation, but I’ve found them to be quite flexible if you can’t fully comply (my attitude was along the lines of “this is what I have - do you want the tax or not?” ![]() ).

).

There’s some more info in this thread:

Yes it will only be 18 percent of 3600 euros. Do you have to go in person or can you File online?

I mean they won’t even know I had any salary. I doubt they can get any information from Cyprus.

You should be able to file online, but you’d of course need to input the details of foreign income into the tax software manually. After submission, you get a form to print out allowing you to pay in a bank/convenience store and you’re supposed to send supporting evidence by mail within 7 days or whatever. A couple of caveats:

- You need some form of ID to register with the tax software (I think it allows an NHI card, an Alien Citizen Digital Certificate, and 2-3 others - not sure). I remember you’re here on a gold card, but I’m not sure whether you have the first two. If not, it’d likely be easier to go to the tax office.

- As you say, you don’t have the supporting documentation. They’ll expect that to be mailed in, and they may contact you later if they think there’s a problem with what you submit (it took them 5-6 months to do that for me). I think it’d be easier for you to just go there and explain your situation and get it sorted. I took my documentation there in person anyway because it was maybe 50-60 pages of invoices etc. and I doubted that they’d understand what I was submitting if I just mailed it (plus it was just as convenient to go to the tax office as to the post office).

- I think your tax will be slightly higher than the NT$20k you’re allowed to pay in a convenience store (IIRC), so you’ll likely need to pay in a bank anyway.

- IIRC, you’re in Taichung. This might be outdated info nowadays, but I understand that the tax offices in other cities are less familiar with the rules for foreigners/overseas income compared with the tax office in Taipei. They might end up telling you something like you don’t need to pay tax on foreign income below NT$6.7 million (incorrect), in which case you can shrug and move on, safe in the knowledge that you tried to pay taxes and a government employee told you they didn’t want it.

Overall, I think it’d be easier and faster going in person, but online might also be doable.

Yeah, I don’t think they’d know if you don’t tell them. That’s your decision, of course. ![]()

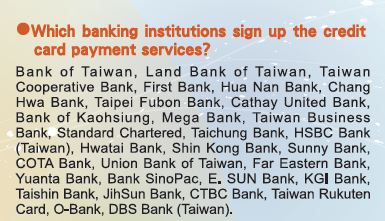

Answering that one: I just tried choosing the “pay by credit card” option without taking to my bank first. Some minutes later, I received the following notification:

(Rough meaning according to Google Translate: You’ve gone over your credit limit. However, we’ve still approved your transaction. But now you need to pay in full!)

I guess that means I won’t be able to use my credit card for some days now. But if I’m lucky, I’ll get 0.2% back - unless that doesn’t apply to payments over the limit… ![]()